Pro Forma Invoice is a starting export document but a very important document for starting an export business and today we will learn how to Draft Pro Forma Invoice For Export Product | Export Import Document step to step process.

Export Proforma Invoice | 2 मिनट में प्रोफोर्मा इनवॉइस बनाये एक्सपोर्ट के लिए

So Today you will learn many unanswered questions about Best Pro Forma Invoice Format for import-export in this article:-

Proforma Invoice FAQ

What Is a Proforma Invoice?

Proforma invoice is one of the most as often as possible produced exchange reports for export import business. A proforma invoice is given by an exporter toward the start of a export payment. It affirms the responsibility of the exporter to sell export product merchandise at a specific cost and at specific incoterms in a proper way.

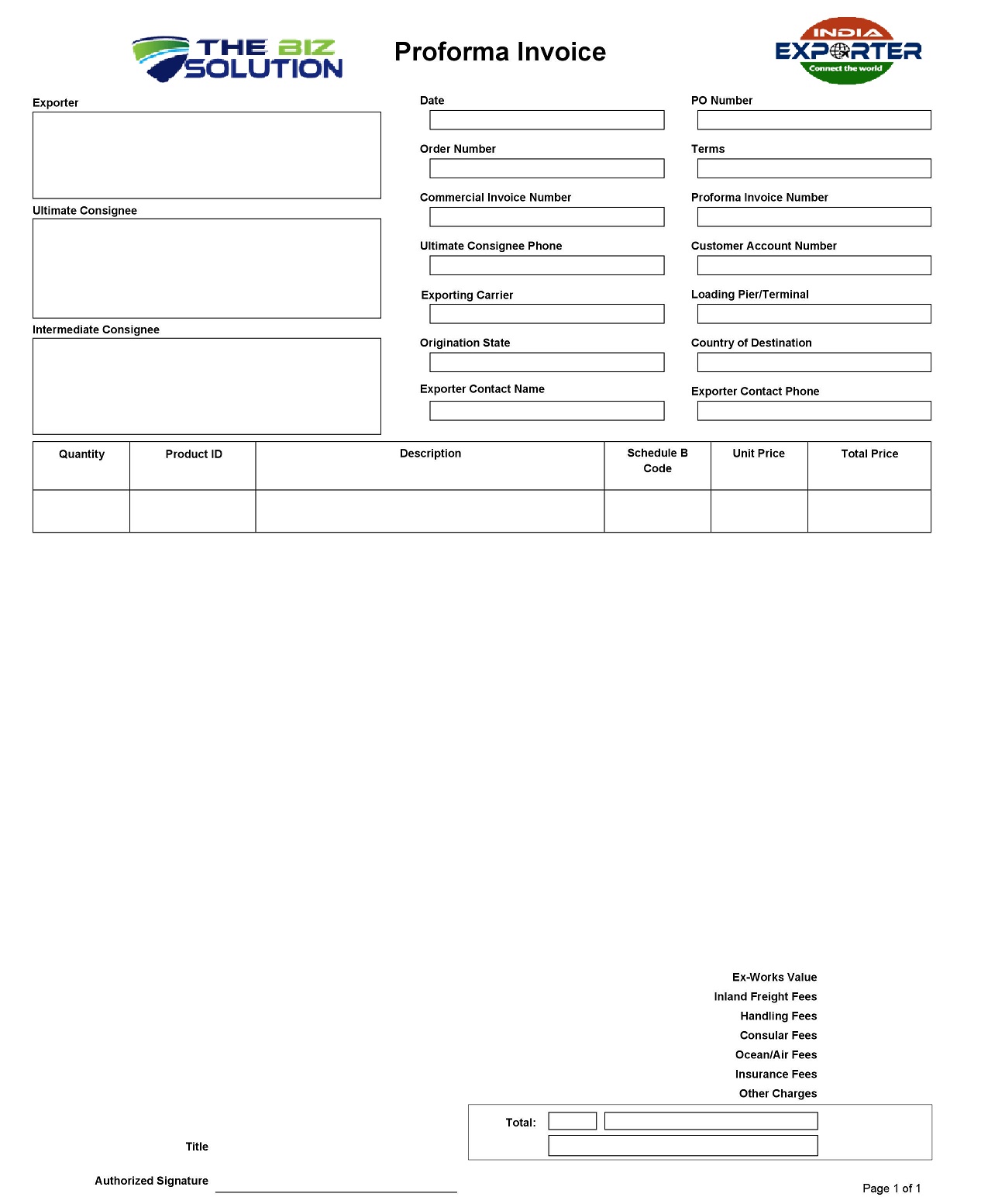

How to Make/ Draft a Proforma Invoice?

In the Important Export Document list for Exporter / Seller, You can say the ProForma invoice is a prima facia export document for starting an export business. Because of its initial export document with the help of that, you can process your deal with international buyers.

What is the purpose of the proforma invoice?

In Simple and easy words you can say A proforma invoice is an important export document that is issued by the seller, the exporter, to the buyer, the importer, to confirm the buyer’s will of purchasing the required product.

Distinguish / Difference between a business Invoice and a Pro-forma Invoice?

Proforma invoices are not used for Business payment purposes. It’s just like a Product price showcase including the cost of freight and all, a pro forma invoice includes two important things—one that certifies that the details added in the proforma invoice are true and correct, and 2nd that indicates the country of origin of the exporting goods. The invoice is also clearly marked on the header part “pro forma invoice.”

Is proforma invoice legally binding in Export payment?

Remember Proforma invoice is completely different from Commercial Invoice. Somehow it’s legally binding your International buyer for legal terms but it’s now useful for customs purposes. Send a Proforma invoice to someone in your circle and try to convert in the purchase order. your final commercial invoice is your true invoice for an export order and you can use Proforma invoice templets for better knowledge.

Pro forma invoice is a regular business invoice that included all the information regarding the calculation of payments of goods that are requested by the Exporter/seller to the Importer/customer. It also includes the commitment of the exporter to deliver the products as requested by the Importer/buyer for a Prefixed price.

Export transactions, particularly initial stage export transactions, start with the request of the quotation from abroad. A pro forma invoice is a quotation / Initial Business Deal Invoice in the format of an international sales invoice; it is the preferred method in the export business.

Drafting / Process of Proforma Invoice Includes the export deal content like:

Remember one thing Proforma invoice is not a just invoice or initial export document, it is a legal export document and you could be bound to the terms and conditions upon your international buyer.

Your Export proforma invoice means it is your offer to sell your product in front of the foreign buyers. So never ever Don’t undervalue proforma invoice.

The main benefit of a pro forma invoice is that it helps in the export sale, which means that the two-person exporter – importer involves in the international transaction, which is the importer/buyer and the exporter/seller has agreed to the terms of the contract which available in the proforma invoice as the sales invoice.

Proforma Invoice Sample – Example

Try to create now a proforma invoice with this idea share as an export transaction with others. Because your letter of credit totally depends on your Proforma Invoice and after that, you can start your export business.

Want to learn more in deep about How to Drafting Pro Forma Invoice Than Watch our special video –

Read Our Other Startup Export Import Business Document Articles –